- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

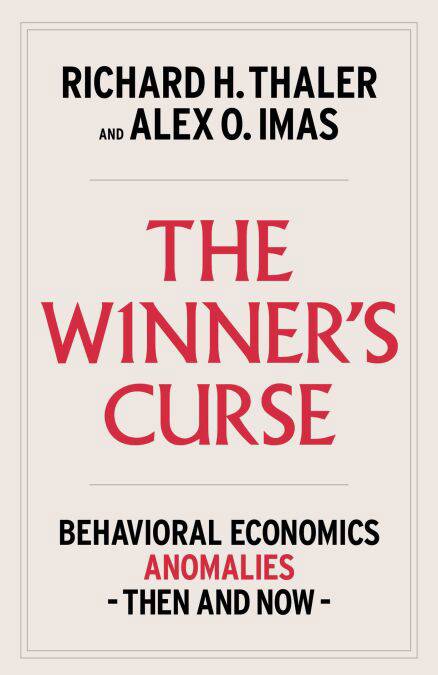

The Winner's Curse E-BOOK

Behavioral Economics Anomalies, Then and Now

Richard H. Thaler, Alex Imas

E-book | Engels

€ 16,76

+ 16 punten

Uitvoering

Omschrijving

Named one of Financial Times’s Best Books of 2025, that bestselling author Tim Hartford called "fun" and "nerdy in the best way"

Nobel Prize winner Richard H. Thaler and rising star economist Alex O. Imas explore the past, present, and cutting-edge future in behavioral economics in The Winner’s Curse.

Why do people cooperate with one another when they have no obvious motivation to do so? Why do we hold on to possessions of little value? And why is the winner of an auction so often disappointed?

Over thirty years ago, Richard H. Thaler introduced readers to behavioral economics in his seminal Anomalies column, written with collaborators including Daniel Kahneman and Amos Tversky. These provocative articles challenged the fundamental idea at the heart of economics that people are selfish, rational optimizers, and provided the foundation for what became behavioral economics. That was then.

Now, three decades later, Thaler has teamed up with economist Alex O. Imas to write a new book with an original and creative format. Each chapter starts with an original Anomaly, retaining the spirit of its time stamp. Then, shifting to the present, the authors provide updates to each, asking how the original findings have held up and how the field has evolved since then.

It turns out that the original findings not only hold up well, but they show up almost everywhere. Anomalies pop up in people’s decisions to save for retirement and how they carry outstanding credit card debt. Even experts fail to optimize. The key concept of loss aversion explains missed putts by PGA pros and the selection of which stocks to sell by portfolio managers. In this era of meme stocks and Dogecoin, it is hard to defend the view that financial markets are highly efficient. The good news, however, is that the anomalies have gotten funnier.

With both readability and rigor, The Winner’s Curse is for anyone, from those with a cursory understanding of economics to fellow economists. Each chapter provides a key insight into human behavior so readers learn how to better understand the choices made by their friends, colleagues, and customers, and they might just become better at making decisions themselves. Only recommended for humans.

Nobel Prize winner Richard H. Thaler and rising star economist Alex O. Imas explore the past, present, and cutting-edge future in behavioral economics in The Winner’s Curse.

Why do people cooperate with one another when they have no obvious motivation to do so? Why do we hold on to possessions of little value? And why is the winner of an auction so often disappointed?

Over thirty years ago, Richard H. Thaler introduced readers to behavioral economics in his seminal Anomalies column, written with collaborators including Daniel Kahneman and Amos Tversky. These provocative articles challenged the fundamental idea at the heart of economics that people are selfish, rational optimizers, and provided the foundation for what became behavioral economics. That was then.

Now, three decades later, Thaler has teamed up with economist Alex O. Imas to write a new book with an original and creative format. Each chapter starts with an original Anomaly, retaining the spirit of its time stamp. Then, shifting to the present, the authors provide updates to each, asking how the original findings have held up and how the field has evolved since then.

It turns out that the original findings not only hold up well, but they show up almost everywhere. Anomalies pop up in people’s decisions to save for retirement and how they carry outstanding credit card debt. Even experts fail to optimize. The key concept of loss aversion explains missed putts by PGA pros and the selection of which stocks to sell by portfolio managers. In this era of meme stocks and Dogecoin, it is hard to defend the view that financial markets are highly efficient. The good news, however, is that the anomalies have gotten funnier.

With both readability and rigor, The Winner’s Curse is for anyone, from those with a cursory understanding of economics to fellow economists. Each chapter provides a key insight into human behavior so readers learn how to better understand the choices made by their friends, colleagues, and customers, and they might just become better at making decisions themselves. Only recommended for humans.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 352

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781982165130

- Verschijningsdatum:

- 20/10/2025

- Uitvoering:

- E-book

- Beveiligd met:

- Adobe DRM

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 16 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.