- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

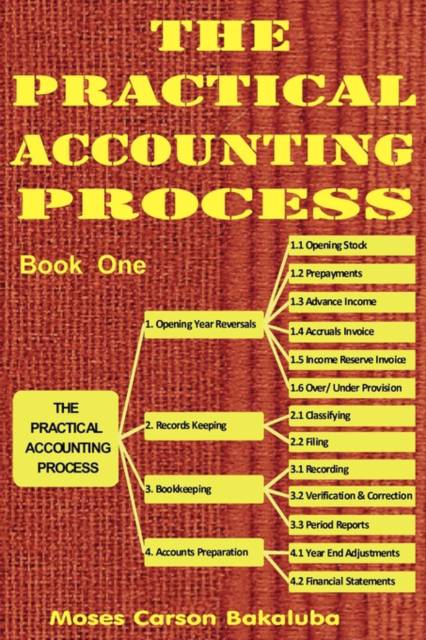

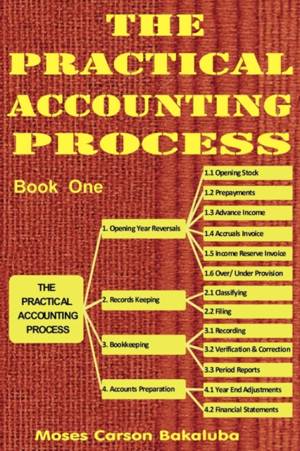

This is one of the few books containing Practical Theory, comprised of extensive guidelines and Accounting Practices. It combines Theory and Practice Based Learning. It brings Practical Bookkeeping and Accounting into the classroom. Its designed to groom Financial Accounting Technicians, able to do all the Bookkeeping, and prepare a comprehensive set of Accounts. Its compiled by an ACCA member, an experienced Accountant, a software designer, an experienced Teacher, and an experienced Author. It covers many issues not found in other books except places of practice like Accounting Firms. These include; converting opening stock into an expense, prepayments into expenses, advance income into income; accruals invoices, income reserve invoices, clearing under and over provisions, documents management, comprehensive Charts of Accounts, cheque receipts account, electronic receipts account, four entries for transactions involving credit and Vat, 6 entries for wage computations, disallowed expenses, agency collections, document numbers replace the folio column, Sales and Purchases journals replaced by Control accounts, cashbook and petty cashbook eliminated, documents replace transactions for practice, vertical instead of horizontal accounts, transaction and period balancing, the Vat fraction, Vat reporting options, Vat accounts modified, Vat Returns and transfers, period and cummulative Trial Balance, balances and entries review, Vat and performance comparison, pre and post Vat recording, posting control accounts, periodical reports and checklist, yearend reversals, Accounts formats for Taxation, Notes to the Accounts, Accounting Schedules and cross referencing, plus others.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 256

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781906380144

- Verschijningsdatum:

- 20/01/2011

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 381 g

Alleen bij Standaard Boekhandel

+ 55 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.