- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

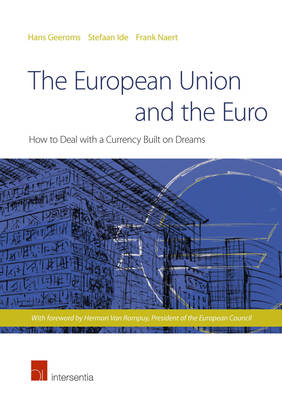

The European Union and the Euro

How to Deal with a Currency Built on Dreams

Hans Geeroms, Stefaan Ide, Frank Naert

Paperback | Engels

€ 52,00

+ 104 punten

Omschrijving

Since 2007, the European Union and the euro (the currency of most of its members) have been struggling, to put it mildly. The EU seems to have lost its competitiveness against the United States and emerging countries. The eurozone crisis has turned into a succession of country crises ebbing and flowing like the tide, threatening to poison the entire eurozone and jeopardizing world economic growth. This book examines the period of turmoil, putting it into a larger historical, institutional, and economic context, and outlining the efforts of the EU and its Member States to escape economic and financial meltdown. The book explains the fundamental elements of the Economic and Monetary Union (EMU) that the EU has been developing for more than half a century, starting from a customs union, via the single market, to the adoption of the euro. The institutional architecture of the EMU is explained in a clear and straightforward way that also pinpoints the weaknesses that have endangered the euro from the very start. Preserving the euro requires the further deepening of the EMU. The book explains the reasons why a fiscal union is needed, as well as the role played by a whole new set of rules that limit budgetary and economic policy freedom of the Member States. It also sets out the need for a banking union with European supervision of financial institutions and a Europe-wide resolution and deposit guarantee scheme. In addition, the new face of monetary policy is analyzed, with its unconventional tools, such as outright monetary transactions and long-term funding of financial institutions. It argues that the euro is a one-way street, that the EMU will be further enlarged, and that finalizing it will require the transfer of yet more national sovereignty to a fully fledged economic union with its own economic government. This long transition period will provoke political and diplomatic tensions in the years to come. The European Union and Euro is the first book to offer a comprehensive and forward-looking view of the eurozone crisis. [Subject: EU Law, Economic Law, Finance Law]

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 356

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781780681832

- Verschijningsdatum:

- 10/02/2014

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 170 mm x 240 mm

- Gewicht:

- 644 g

Alleen bij Standaard Boekhandel

+ 104 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.