- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

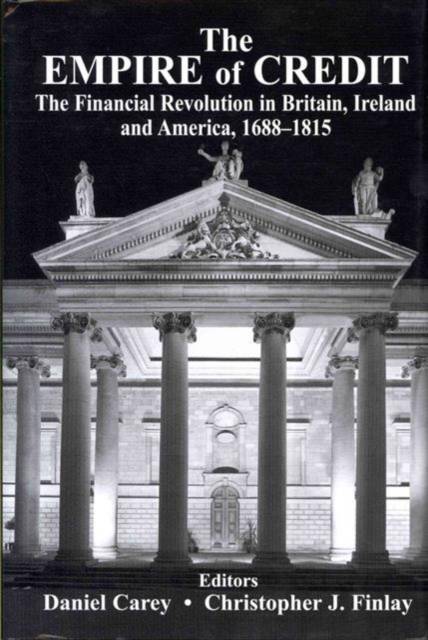

The Empire of Credit

The Financial Revolution in the British Atlantic World, 1688-1815

Hardcover | Engels

€ 62,95

+ 125 punten

Omschrijving

The Empire of Credit explores crucial questions arising from the initial creation of public debt, as well as new forms of credit, in late 17th- and 18th-century Ireland, Britain, and the US. This period saw: the establishment of national banks designed to finance government expenditure, vastly expanded tax regimes, and the appearance of novel credit instruments (from national lotteries to annuities). Collectively, these developments formed the basis of the 'Financial Revolution.' How differently did these events play out in Ireland, Britain, and the US? What circumstances governed the development of banking, finance, and trade among the players in an empire formed by credit? The Empire of Credit discusses rival philosophies of money among the major intellectual figures of the period (including Locke, Hume, and Adam Smith) * the role of the State in securing public loyalty through investment in national debt * the continued need for hard currency, even as new forms of credit and paper money began to enter widespread circulation * the US trading relationship with Britain and the crisis in currency after Independence * Ireland's distinctive position of being the country that remained outside the union formed between Scotland and England, yet was integrated into British and US markets while innovating in finance and banking along lines established in England.

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 320

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780716534150

- Verschijningsdatum:

- 14/06/2011

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 159 mm x 235 mm

- Gewicht:

- 630 g

Alleen bij Standaard Boekhandel

+ 125 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.