- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

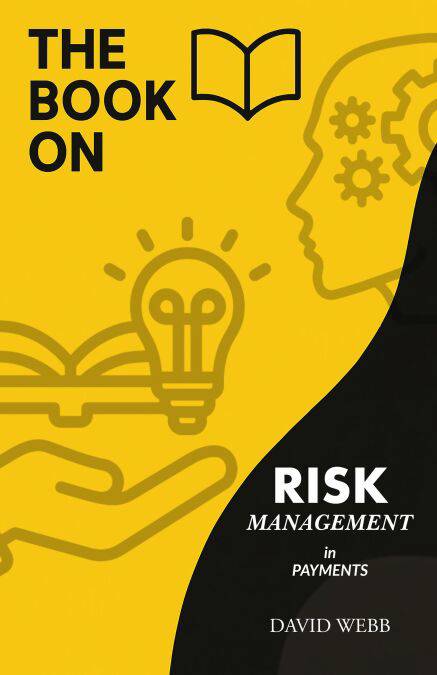

The Book On Risk Management is a modern, deeply practical guide to understanding the risks that shape today's digital payments ecosystem—and how to manage them at scale. From swipe to settlement, every transaction exposes financial platforms, fintechs, and banks to a range of evolving threats: fraud, compliance gaps, operational failures, and reputational damage.

This book offers the insight, structure, and real-world context needed to navigate those risks and build resilient systems that move not just money—but trust.

You'll discover:

How payment ecosystems actually work—who the players are, how value moves, and where risk lives

The key categories of risk facing modern platforms: financial, fraud, cyber, regulatory, and reputational

The shifting landscape of global regulations, including PSD2, PCI DSS, AML/KYC, GDPR, and U.S. frameworks

Real-time payment rails and the rise of decentralized, API-driven platforms

What fintechs, PSPs, acquirers, and embedded platforms must do to stay compliant, secure, and scalable

Why decentralization and innovation have changed the rules—and how to adapt before it's too late

Written for compliance professionals, fintech founders, product leads, fraud teams, regulators, and anyone responsible for protecting payments in motion, this book connects strategy with action. It unpacks not only the threats, but the frameworks, habits, and infrastructure that mitigate them in an always-on, high-stakes environment.

Whether you're securing a billion-dollar platform or building your first payments product, The Book On Payments at Risk will help you see what others miss—and act before it's too late.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9798231059676

- Verschijningsdatum:

- 5/05/2025

- Uitvoering:

- E-book

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.