- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

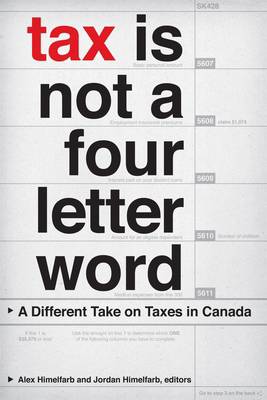

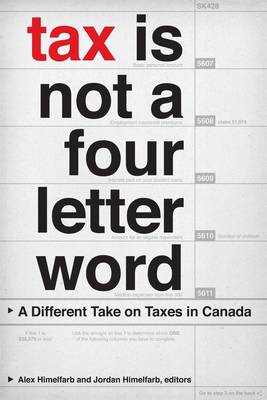

Tax Is Not a Four-Letter Word

A Different Take on Taxes in Canada

Omschrijving

Taxes connect us to one another, to the common good, and to the future. This is a book about taxes: who pays what and who gets what. More than that, it's about the role of government, about citizenship and our collective well-being, about the Canada we want. The contributors, leading Canadian practitioners and scholars, explore how taxes have become a political "no-go zone" and how changes in taxation are changing Canada. They challenge the view that any tax is a bad tax and provide broad directions for fairer and smarter approaches.

This is a book that will be of interest to anyone concerned with public policy and public affairs, economics, and political science and to anyone interested in challenging the conventional wisdom that lower taxes and smaller government are the cures to what ails us.

Specificaties

Betrokkenen

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 304

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 3

Eigenschappen

- Productcode (EAN):

- 9781554588329

- Verschijningsdatum:

- 8/11/2013

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 430 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.