- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 246,95

+ 493 punten

Omschrijving

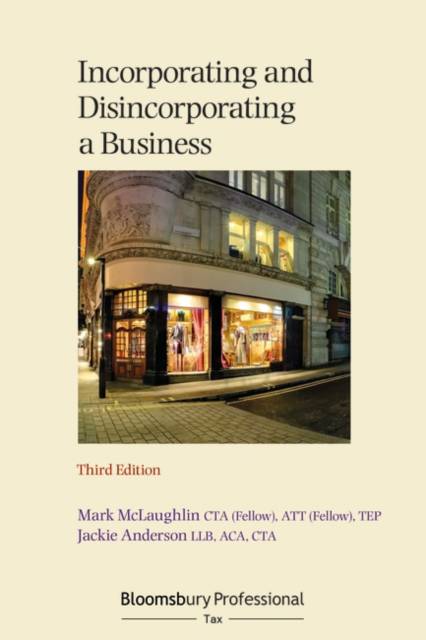

Incorporating and Disincorporating a Business, Third Edition provides clear, detailed and practical guidance on the tax issues, planning points and pitfalls which may be encountered when incorporating a sole trader or partnership business, or when transferring a company's business to a sole trader or partnership.

This authoritative handbook includes detailed coverage on all tax issues that might apply to small businesses, including income tax and NICs, CGT, IHT, VAT and stamp taxes as well as in-depth content on how to deal with legal and accounting compliance issues. Since the publication of the last edition in early 2016, there has been significant legislative change reflected in several Finance Acts. This edition has been updated to reflect those changes. The changes include: Entrepreneurs' relief: the relief restriction on the acquisition of goodwill from related parties (FA 2016) and subsequent changes to the relief conditions (FA 2019)Dividend tax reforms (FA 2016)

The 'anti-phoenixism' targeted anti-abuse rule (FA 2016)

Change in tax rate for loans to participators (FA 2016)

Capital allowances changes - including increase in annual investment allowance and the new structures and buildings allowance (FA 2019) The practical assistance contained within this book includes numerous worked examples, key point summaries, pro-forma elections and tables comparing the overall tax position for incorporated and unincorporated business owners, including the comparative tax impact of a bonus vs dividends. This edition includes a chapter on the complex area of incorporating a limited liability partnership and a new chapter on incorporating a rental property business. The user-friendly structure features 'signposts' at the beginning of each chapter to provide a useful summary of the main points and 'focus points' which highlight important issues in each chapter. Tax practitioners, accountants and business proprietors will all benefit from the expert guidance offered by this book.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 552

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781526507693

- Verschijningsdatum:

- 25/04/2019

- Uitvoering:

- Paperback

- Bestandsformaat:

- Trade paperback (VS)

- Afmetingen:

- 161 mm x 231 mm

- Gewicht:

- 367 g

Alleen bij Standaard Boekhandel

+ 493 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.