- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

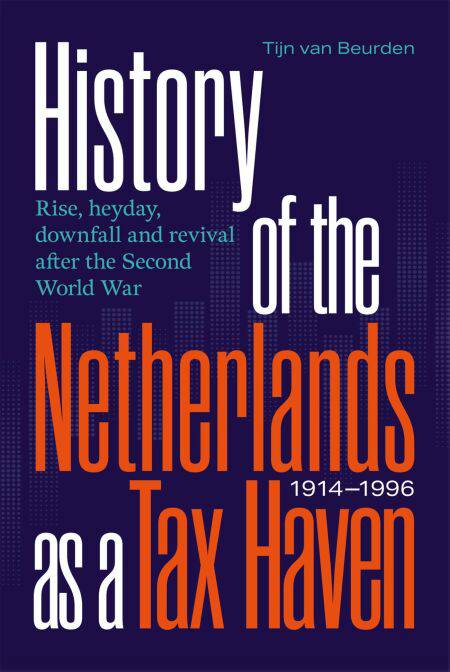

History of the Netherlands as a Tax Haven, 1914-1996 E-BOOK

Rise, heyday, downfall and revival after the Second World War

Tijn van Beurden

E-book | Engels

€ 14,50

+ 14 punten

Uitvoering

Omschrijving

The Dutch tax haven, originating in WWI, thrived on banking secrecy but declined after WWII. It later evolved into a corporate tax haven through treaties, exemptions, and tax rulings.

The Dutch tax haven is much older than most would assume and has undergone several stages of development. It arose during World War I, when foreign capital refugees and German companies started to take advantage of existing facilities such as banking secrecy and numbered bank accounts. During the interwar period, the Dutch and Swiss tax havens became the most important in Europe. Due to international tensions and the threat of war a lot of flight capital left the Netherlands, mainly to the United States. That meant the downfall of the Dutch tax haven. Just after World War II, the Dutch government abolished banking secrecy. Therefore, the pre-war tax haven could not be re-established, since it was largely based on secrecy. But through a growing tax treaty network, a generous participation exemption, and attractive tax rulings, the Netherlands was able to develop into one of the most important tax havens for companies.

This is the first archive-based study that covers the complete history of the Dutch tax haven, making it an essential read for anyone seeking to understand the factors that determine the rise, growth and decline of tax havens.

Tijn van Beurden is an independent researcher who wrote his PhD dissertation on the history of the Curaçao tax haven. In 2021 he and J. Jonker co-authored an article in Financial History Review about the symbiosis between the Dutch and Curaçao offshore sector. In 2023, Palgrave published his article on the Shell oil company's methods of tax evasion.

The Dutch tax haven is much older than most would assume and has undergone several stages of development. It arose during World War I, when foreign capital refugees and German companies started to take advantage of existing facilities such as banking secrecy and numbered bank accounts. During the interwar period, the Dutch and Swiss tax havens became the most important in Europe. Due to international tensions and the threat of war a lot of flight capital left the Netherlands, mainly to the United States. That meant the downfall of the Dutch tax haven. Just after World War II, the Dutch government abolished banking secrecy. Therefore, the pre-war tax haven could not be re-established, since it was largely based on secrecy. But through a growing tax treaty network, a generous participation exemption, and attractive tax rulings, the Netherlands was able to develop into one of the most important tax havens for companies.

This is the first archive-based study that covers the complete history of the Dutch tax haven, making it an essential read for anyone seeking to understand the factors that determine the rise, growth and decline of tax havens.

Tijn van Beurden is an independent researcher who wrote his PhD dissertation on the history of the Curaçao tax haven. In 2021 he and J. Jonker co-authored an article in Financial History Review about the symbiosis between the Dutch and Curaçao offshore sector. In 2023, Palgrave published his article on the Shell oil company's methods of tax evasion.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 240

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9789463015455

- Verschijningsdatum:

- 10/02/2025

- Uitvoering:

- E-book

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 14 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.