- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

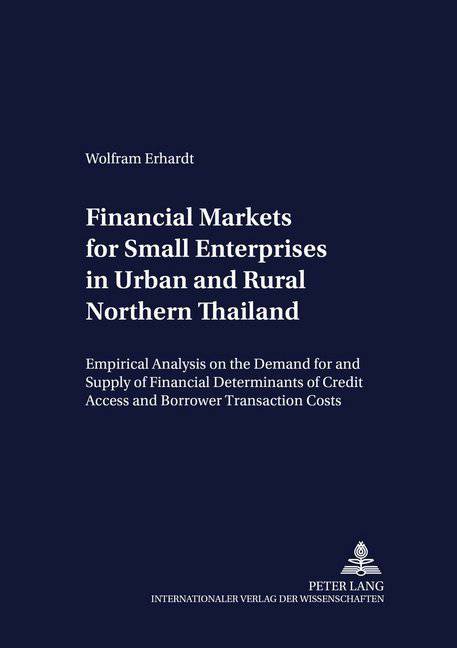

Financial Markets for Small Enterprises in Urban and Rural Northern Thailand

Empirical Analysis on the Demand for and Supply of Financial Services, with Particular Emphasis on the Determinants of Credit Access and Borrower Transaction Costs

Wolfram Erhardt

€ 61,95

+ 123 punten

Omschrijving

This study examines the demand for and supply of financial services for small entrepreneurs in Northern Thailand. Particular emphasis is placed on credit technologies deployed by formal and informal institutions and on determinants of credit access and borrower transaction costs. The study complements and expands on existing research into micro-finance by adding a specific regional dimension. A remarkable situation of «urban bias in reverse» has been detected as far as access to formal finance is concerned. Conventional access variables (such as education and the level of household income and assets) do not explain rural households' access to institutional credit sources, while these factors turned out to be powerful determinants in explaning urban households' access to formal finance. This can be explained by the efforts on the part of the Thai government to improve access to credit for small rural enterprises. The author concludes that the neglect of rural finance and the lack of innovative financial approaches is, to a significant extent, also the result of political priority-setting and decision-making; it cannot be attributed to unattractive investment possibilities alone.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 221

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 28

Eigenschappen

- Productcode (EAN):

- 9783631380673

- Verschijningsdatum:

- 16/05/2002

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 148 mm x 210 mm

- Gewicht:

- 329 g

Alleen bij Standaard Boekhandel

+ 123 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.