- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

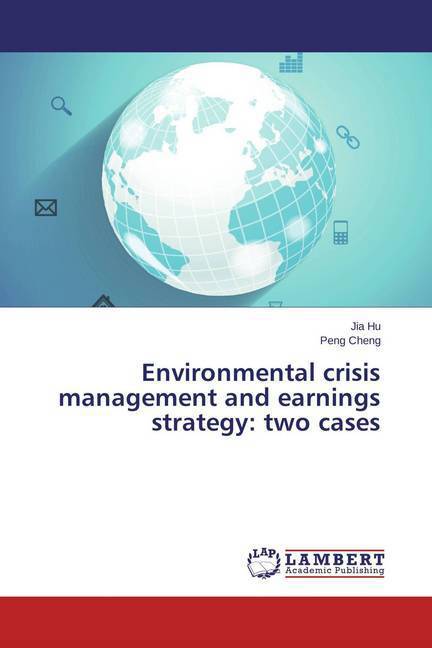

Environmental crisis management and earnings strategy

two cases

Hu Jia, Cheng Peng

Paperback | Engels

€ 39,45

+ 78 punten

Omschrijving

This paper examines the accounting choice in a response to a major environmental crisis by looking at BP (British Petroleum) and Zijin Mining (a mining firm listed on Shanghai Stock Exchange, ZM hereafter), both of which face an environmental crisis at a similar level in 2010. The results show that BP may overly recognize crisis-related expenses in the year of crisis, suggesting that BP is likely to use the income-decreasing earnings management (e.g., big bath accounting etc.) as a response to the crisis. Then, BP partly reverses the expenses and pushes up reported earnings in the subsequent year. On the contrary, ZM's operating performance (sales growth & profitability) and stock performance seem to be superior subsequent to the crisis. Importantly, we find that the firm uses income-increasing accruals management to boost reported earnings. Further data investigation indicates that several specific accruals have been inflated in the year of crisis: i.e., provisions for asset impairment, accounts receivables and inventories. In addition, a few real earnings management items have been examined, but the findings are mixed.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 72

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783659613067

- Verschijningsdatum:

- 15/10/2014

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 117 g

Alleen bij Standaard Boekhandel

+ 78 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.