- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

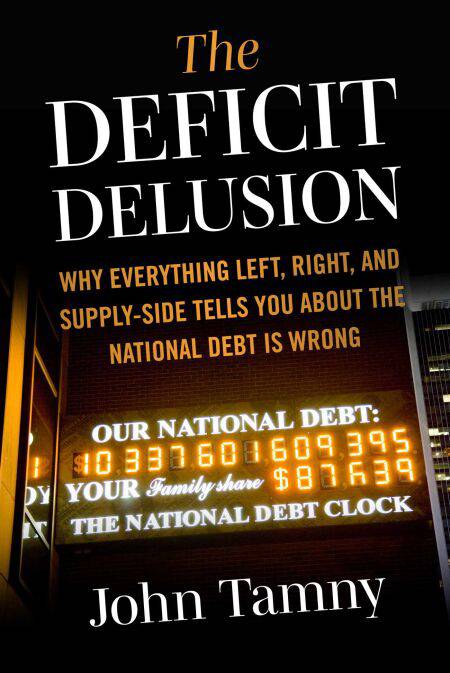

Deficit Delusion E-BOOK

Why Everything Left, Right, and Supply-Side Tells You About the National Debt Is Wrong

John Tamny

E-book | Engels

€ 24,59

+ 24 punten

Uitvoering

Omschrijving

There’s a growing consensus about the causes of budget deficits and the national debt. And that’s the problem.

At present, members of the Left claim that higher rates of taxation levied on the rich are the fix, members of the Right call for a combination of spending cuts, tax increases and entitlement reform, while supply siders confidently assert that the path out of debt is tax cuts that will shower the Treasury with higher tax revenues borne of soaring economic growth. The solutions flamboyantly mistake the problem.

In his latest and arguably most pathbreaking book, Parkview Institute president John Tamny asks readers to contemplate government debt in an all-new way, and in doing so makes a powerful case that deficits and the national debt will continue to grow precisely because left, right and supply side profoundly misunderstand why there’s debt in the first place.

While the warring ideologies promote what they imagine are different solutions to the perceived debt problem, it’s lost on them that they’re basically saying the same thing: an insufficiency of federal tax revenue has resulted in deficits and debt that seemingly soar without endpoint. Tamny makes a case that the arguments fail repeatedly precisely because they’re backwards.

Drawing on examples from private individuals and businesses, Tamny turns the debt discussion on its head. Far from a signal of insufficient revenue, Tamny shows that government debt is a logical and perilous effect of market optimism about rising tax revenues now, and much more dangerous, the expectation of exponentially more tax revenue in the future.

Readers of The Deficit Delusion will gradually see the folly of a deficit and debt discussion that has grown stale and terribly confused, all the while looking at the Reagan tax cuts, skyrocketing government debt in California, entitlement reform, and the soaring national debt through an entirely different lens. Far from an apology for all the government debt, Tamny makes a passionate case that the debt crisis is not what the alarmists of the competing ideologies imagine it to be, but is instead one of soaring tax revenue itself that, if unchecked, will render the national debt of the moment rather pedestrian in comparison to what’s ahead.

For far too long readers have been inundated with the same arguments and same solutions dressed up differently to feed the differing views of the competing ideologies. With The Deficit Delusion, readers finally have a book that will prove the mask-off moment for left, right and supply side.

At present, members of the Left claim that higher rates of taxation levied on the rich are the fix, members of the Right call for a combination of spending cuts, tax increases and entitlement reform, while supply siders confidently assert that the path out of debt is tax cuts that will shower the Treasury with higher tax revenues borne of soaring economic growth. The solutions flamboyantly mistake the problem.

In his latest and arguably most pathbreaking book, Parkview Institute president John Tamny asks readers to contemplate government debt in an all-new way, and in doing so makes a powerful case that deficits and the national debt will continue to grow precisely because left, right and supply side profoundly misunderstand why there’s debt in the first place.

While the warring ideologies promote what they imagine are different solutions to the perceived debt problem, it’s lost on them that they’re basically saying the same thing: an insufficiency of federal tax revenue has resulted in deficits and debt that seemingly soar without endpoint. Tamny makes a case that the arguments fail repeatedly precisely because they’re backwards.

Drawing on examples from private individuals and businesses, Tamny turns the debt discussion on its head. Far from a signal of insufficient revenue, Tamny shows that government debt is a logical and perilous effect of market optimism about rising tax revenues now, and much more dangerous, the expectation of exponentially more tax revenue in the future.

Readers of The Deficit Delusion will gradually see the folly of a deficit and debt discussion that has grown stale and terribly confused, all the while looking at the Reagan tax cuts, skyrocketing government debt in California, entitlement reform, and the soaring national debt through an entirely different lens. Far from an apology for all the government debt, Tamny makes a passionate case that the debt crisis is not what the alarmists of the competing ideologies imagine it to be, but is instead one of soaring tax revenue itself that, if unchecked, will render the national debt of the moment rather pedestrian in comparison to what’s ahead.

For far too long readers have been inundated with the same arguments and same solutions dressed up differently to feed the differing views of the competing ideologies. With The Deficit Delusion, readers finally have a book that will prove the mask-off moment for left, right and supply side.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 240

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781510784888

- Verschijningsdatum:

- 18/08/2025

- Uitvoering:

- E-book

- Beveiligd met:

- Adobe DRM

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 24 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.