- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

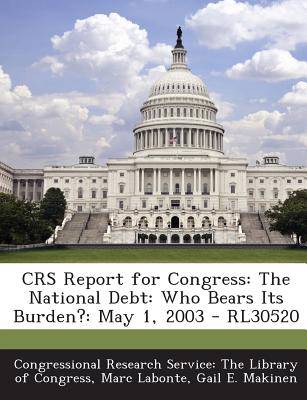

Crs Report for Congress

The National Debt: Who Bears Its Burden?: May 1, 2003 - Rl30520

Marc LaBonte, Gail E Makinen

Paperback | Engels

€ 20,45

+ 40 punten

Omschrijving

The United States has been free of a national debt for only 2 years, 1834 and 1835. We began our existence as a country in 1790 with a debt of $75 million. It rose to $3.8 trillion in 1997. It rose to a high of 108.6% of gross domestic product (GDP) at the end of World War II; declined to a post-World War II low of 23.8% of GDP in 1974; and, then, rose to another high of 49.5% of GDP in 1993. The major cause of debt accumulation has been war. The United States has financed the extraordinary expenditures associated with war by borrowing rather than by raising taxes or printing money. This pattern was broken by the large budget deficits of the 1980s and 1990s which caused the national debt to rise substantially as a fraction of GDP during peacetime. While economists have long recognized that a national debt imposes an inescapable burden on a nation, they have debated whether the burden is borne by the generation who contracts the debt or is shifted forward to future generations. There has also been some controversy over the nature of the burden. The current consensus among economists is that the ...

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 24

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781293023327

- Verschijningsdatum:

- 10/10/2013

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 189 mm x 246 mm

- Gewicht:

- 63 g

Alleen bij Standaard Boekhandel

+ 40 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.