- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 106,95

+ 213 punten

Omschrijving

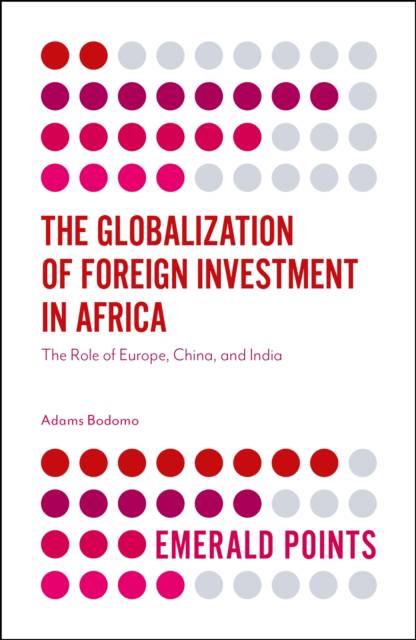

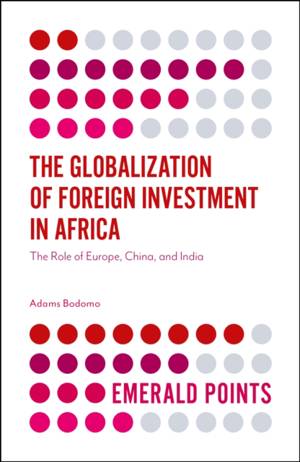

The 21st century era of globalization has opened up many investment alternatives for Africa. There is now a rush by governments and private companies to expand in the rapidly growing region, to the extent that we can begin to talk of a process of world-wide investment. Both traditionally powerful economies in the West and emerging powers such as China and India have contributed to a vast proliferation of investment, raising questions of what intense competition will mean for Africa's economic development. The Globalization of Foreign Investment in Africa: The Role of Europe, China, and India compares the differing approaches between Asian and European players in Africa, with a particular focus on the role of foreign direct investment (FDI) in the socio-economic, socio-political, and socio-cultural development of the region. First documenting the historical context of Western dominance from European colonial powers, the book follows the paradigm shift that occurred with China's 21st century foray into Africa in search of oil and other raw materials to fuel its own rapidly rising economy. Using an interdisciplinary approach, the author proposes that Africa will only get maximum benefits from high-level investment activities if it succeeds in evolving an Africa-driven foreign investment policy. This strategy presents the best scenario for an African economic renaissance in the 21st century. An important contribution to research on contemporary Afro-Asian dynamics, this book will be of interest to students and academics of African Studies, Asian Studies, globalization, and economics, as well as potential investors and investing agencies.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 136

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781787433588

- Verschijningsdatum:

- 31/10/2017

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 127 mm x 196 mm

- Gewicht:

- 140 g

Alleen bij Standaard Boekhandel

+ 213 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.