- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

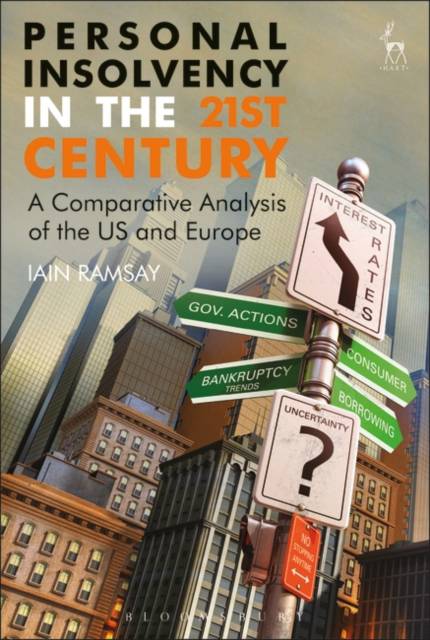

Personal Insolvency in the 21st Century

A Comparative Analysis of the US and Europe

Iain Ramsay

Hardcover | Engels

€ 195,45

+ 390 punten

Uitvoering

Omschrijving

Since 1979 the world has witnessed a remarkable cycle of personal insolvency law reform. Changes in capitalist economies, financial crises and political interest groups all contributed to this cycle of reform. This book examines the role of interest groups and distinct narratives in shaping reform in different countries while drawing attention to the role of timing, path dependency and unintended consequences in the development of personal insolvency law.

The book presents case studies of personal insolvency law in the US, France, Sweden, and England and Wales. It then analyses how, following the Great Recession of 2008, international financial institutions paid greater attention to the significance of household debt in contributing to financial instability and the role of individual insolvency law in providing a fresh start. Personal insolvency law reform became part of EU responses to the eurozone crisis and the EU has proposed harmonisation of individual insolvency law to promote entrepreneurialism. This book examines the extent to which these developments represent an emerging international commonsense about personal insolvency and its relationship to neo-liberalism. Finally, this book discusses whether the international emergence of individual personal insolvency law represents a progressive step or a band-aid for the costs of neo-liberal policies, where a significant number of people live close to the precipice of over-indebtedness.

The book presents case studies of personal insolvency law in the US, France, Sweden, and England and Wales. It then analyses how, following the Great Recession of 2008, international financial institutions paid greater attention to the significance of household debt in contributing to financial instability and the role of individual insolvency law in providing a fresh start. Personal insolvency law reform became part of EU responses to the eurozone crisis and the EU has proposed harmonisation of individual insolvency law to promote entrepreneurialism. This book examines the extent to which these developments represent an emerging international commonsense about personal insolvency and its relationship to neo-liberalism. Finally, this book discusses whether the international emergence of individual personal insolvency law represents a progressive step or a band-aid for the costs of neo-liberal policies, where a significant number of people live close to the precipice of over-indebtedness.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 224

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781849468091

- Verschijningsdatum:

- 4/05/2017

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 157 mm x 236 mm

- Gewicht:

- 517 g

Alleen bij Standaard Boekhandel

+ 390 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.