- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 101,95

+ 203 punten

Uitvoering

Omschrijving

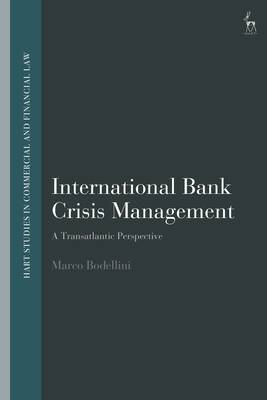

This book analyses the legal regimes governing bank crisis management in the EU, UK, and US, discussing the different procedures and tools available as well as the regulatory architecture and the authorities involved.

Building on a broad working definition of 'bank crisis management' and referring to several cases, the book explores the techniques and approaches employed by the authorities to deal with troubled banks on both sides of the Atlantic. The legal analysis distinguishes between procedures and tools aimed at liquidating the bank in crisis vis-à-vis those aimed at restructuring. In this regard, attention is paid to the rules allowing for the use of public money in handling banks in trouble as well as to the role that deposit insurance schemes can play. Considerations on the impact on banks of the current crisis provoked by the COVID-19 pandemic are advanced, primarily focusing on the expected surge of non-performing loans as well as on ways to effectively manage these assets.

The book approaches these issues from a comparative law perspective, providing law and economics considerations and focusing on strengths and drawbacks of the rules currently in force. The book advances policy considerations as well as reform proposals aiming at enhancing the legal regimes in force, with particular reference to the Consultation promoted in 2021 by the European Commission on the adoption of a new bank crisis management and deposit insurance framework in the Union.

Building on a broad working definition of 'bank crisis management' and referring to several cases, the book explores the techniques and approaches employed by the authorities to deal with troubled banks on both sides of the Atlantic. The legal analysis distinguishes between procedures and tools aimed at liquidating the bank in crisis vis-à-vis those aimed at restructuring. In this regard, attention is paid to the rules allowing for the use of public money in handling banks in trouble as well as to the role that deposit insurance schemes can play. Considerations on the impact on banks of the current crisis provoked by the COVID-19 pandemic are advanced, primarily focusing on the expected surge of non-performing loans as well as on ways to effectively manage these assets.

The book approaches these issues from a comparative law perspective, providing law and economics considerations and focusing on strengths and drawbacks of the rules currently in force. The book advances policy considerations as well as reform proposals aiming at enhancing the legal regimes in force, with particular reference to the Consultation promoted in 2021 by the European Commission on the adoption of a new bank crisis management and deposit insurance framework in the Union.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 232

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781509961344

- Verschijningsdatum:

- 22/02/2024

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 326 g

Alleen bij Standaard Boekhandel

+ 203 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.