Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 131,99

+ 263 punten

Omschrijving

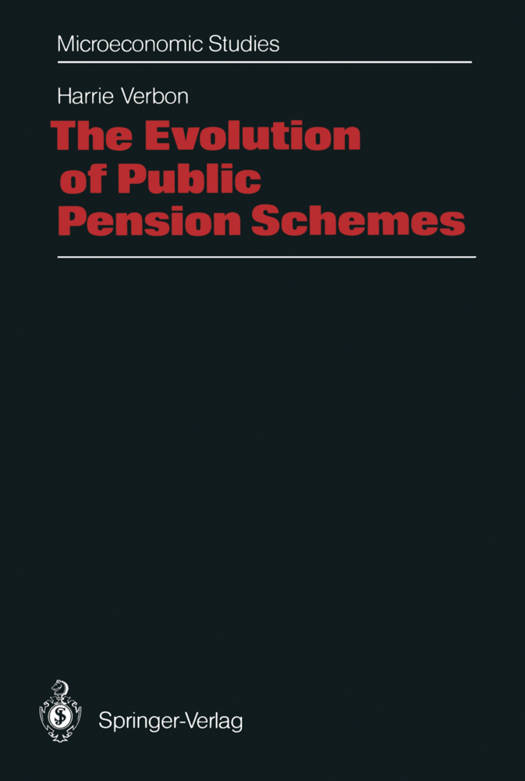

1. 1 An introduction to the problem This book deals with the development of public pension schemes. The operation of public pension schemes has drawn a great deal of attention recently due to ageing of the population which has become apparent since the 19 70s. This would probably have been less of a problem if these schemes had been financed by a Capital Reserve (abbreviated from now on as CR) system. As is well-known, in a pure CR-system individuals (or generations) save for their own retirement. The (average) rate of return on the premiums paid in this system equals the real rate of interest and, in principle, changes in the rate of population growth do not affect the premium rate or the benefit rate of the system. Most public pension schemes, however, are financed by a Pay-As-You-Go (abbreviated from now on as PAYG) system. In this system current pension payments are financed by current premium payments. In contrast to the CR-system intergenerational transfers occur in this system. If the number of retired people increases relative to the number of workers the premium rate will increase under PAYG. In itself this increase does not have to imply any concern for the premium paying population. What counts is whether the rate of return under a PAYG-system will fall (too far) below the rate of return the CR-system is offering.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 287

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783642456558

- Verschijningsdatum:

- 9/03/2012

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 170 mm x 244 mm

- Gewicht:

- 485 g

Alleen bij Standaard Boekhandel

+ 263 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.