- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

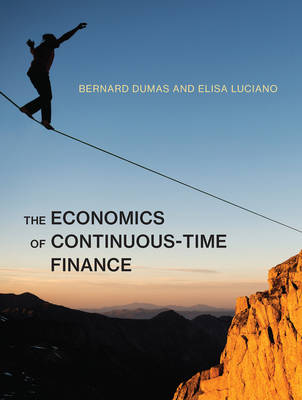

This book introduces the economic applications of the theory of continuous-time finance, with the goal of enabling the construction of realistic models, particularly those involving incomplete markets. Indeed, most recent applications of continuous-time finance aim to capture the imperfections and dysfunctions of financial markets--characteristics that became especially apparent during the market turmoil that started in 2008.

The book begins by using discrete time to illustrate the basic mechanisms and introduce such notions as completeness, redundant pricing, and no arbitrage. It develops the continuous-time analog of those mechanisms and introduces the powerful tools of stochastic calculus. Going beyond other textbooks, the book then focuses on the study of markets in which some form of incompleteness, volatility, heterogeneity, friction, or behavioral subtlety arises. After presenting solutions methods for control problems and related partial differential equations, the text examines portfolio optimization and equilibrium in incomplete markets, interest rate and fixed-income modeling, and stochastic volatility. Finally, it presents models where investors form different beliefs or suffer frictions, form habits, or have recursive utilities, studying the effects not only on optimal portfolio choices but also on equilibrium, or the price of primitive securities. The book strikes a balance between mathematical rigor and the need for economic interpretation of financial market regularities, although with an emphasis on the latter.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 640

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780262036542

- Verschijningsdatum:

- 27/10/2017

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 183 mm x 229 mm

- Gewicht:

- 997 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.