- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 68,95

+ 137 punten

Omschrijving

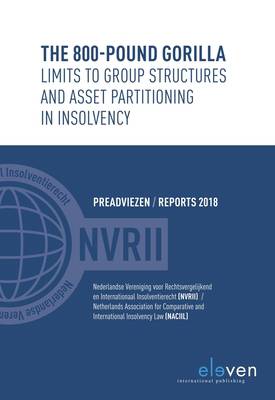

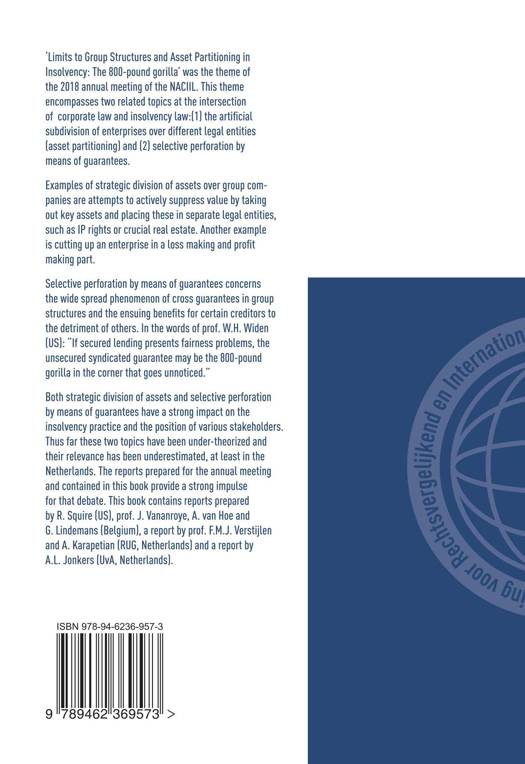

'Limits to Group Structures and Asset Partitioning in Insolvency: The 800-pound gorilla' was the theme of the 2018 annual meeting of the NACIIL. This theme encompasses two related topics at the intersection of corporate law and insolvency law: (1) the artificial subdivision of enterprises over different legal entities (asset partitioning) and (2) selective perforation by means of guarantees. Examples of strategic division of assets over group companies are attempts to actively suppress value by taking out key assets and placing these in separate legal entities, such as IP rights or crucial real estate. Another example is cutting up an enterprise in a loss making and profit making part. Selective perforation by means of guarantees concerns the wide spread phenomenon of cross guarantees in group structures and the ensuing benefits for certain creditors to the detriment of others. In the words of prof. W.H. Widen (US): "If secured lending presents fairness problems, the unsecured syndicated guarantee may be the 800-pound gorilla in the corner that goes unnoticed." Both strategic division of assets and selective perforation by means of guarantees have a strong impact on the insolvency practice and the position of various stakeholders. Thus far these two topics have been under-theorized and their relevance has been underestimated, at least in the Netherlands. The reports prepared for the annual meeting and contained in this book provide a strong impulse for that debate. This book contains reports prepared by R. Squire (US), prof. J. Vananroye, A. van Hoe and G. Lindemans (Belgium), a report by prof. F.M.J. Verstijlen and A. Karapetian (RUG, Netherlands) and a report by A.L. Jonkers (UvA, Netherlands).

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 108

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9789462369573

- Verschijningsdatum:

- 29/07/2019

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 170 mm x 244 mm

- Gewicht:

- 186 g

Alleen bij Standaard Boekhandel

+ 137 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.