- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

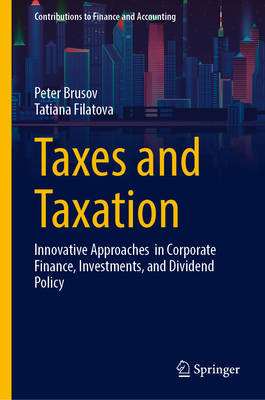

Taxes and Taxation

Innovative Approaches in Corporate Finance, Investments, and Dividend Policy

Peter Brusov, Tatiana FilatovaOmschrijving

This book presents a novel analytical framework for examining the role of taxation in corporate finance, grounded in the Brusov Filatova Orekhova (BFO) theory and its perpetuity limit the Modigliani Miller (MM) theory. The authors investigate the influence of taxation on key financial indicators and investment project performance, incorporating the practical realities of corporate operations, such as the timing and frequency of tax payments and income variability.

The book formulates evidence-based recommendations for regulatory bodies concerning the structure, timing, and differentiation of profit tax payments, particularly in relation to corporate debt levels and other financial characteristics. It also provides strategic guidance for firms in selecting optimal tax payment methodologies.

Furthermore, the authors explore the implications of tax burden on dividend policy and identify a range of innovative effects with the potential to inform both regulatory tax policy and managerial decision-making. This work contributes to the advancement of financial theory by integrating taxation into dynamic investment and capital structure models under realistic economic conditions.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 526

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783032110763

- Verschijningsdatum:

- 29/01/2026

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 155 mm x 235 mm

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.