- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 44,45

+ 88 punten

Omschrijving

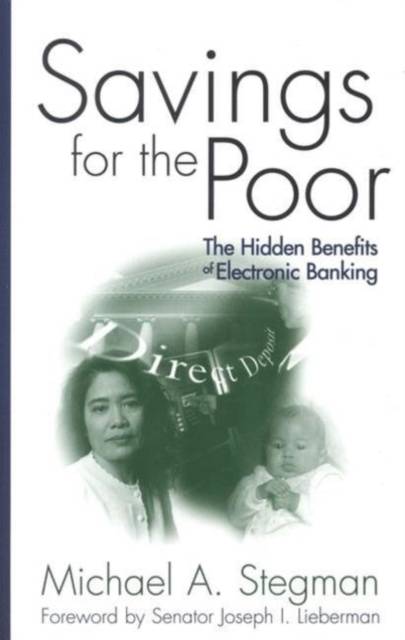

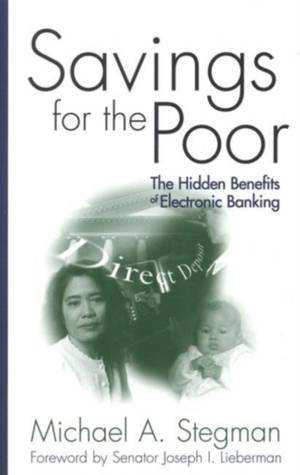

Beginning this year, federal payment recipients will receive their government benefits through electronic funds transfer (EFT)-- what most of us call direct deposit. Although cost-cutting is the driving force behind the move to a virtually all-electronic federal payment system, Michael Stegman believes the initiative has a far broader potential: to bring poor Americans into the banking mainstream. In this book Stegman outlines how many families will enter the mainstream banking system through EFT '99, as the program is called. He explains in careful detail the thinking behind the shift to EFT and the implementation of the program this year. He also argues that, for maximum success, EFT '99 should be combined with a program of national Individual Development Accounts (IDAs), dedicated savings accounts for low-income people that can be used for purchasing a first home, acquiring more education or job training, or starting a small-business. Essentially, EFT '99 will bring people into the banking system, and IDAs will give them an incentive to use the system to its fullest in order to make their money work for them and their children. There are other steps that the government can take to boost EFT's ability to help public aid recipients achieve self-sufficiency. It can: add a direct deposit option to state benefits payments programs; give banks significant additional Community Reinvestment Act Credit for establishing accounts for EFT recipients; and regulate fees for cashing government benefits and voluntary accounts so that people are not charged excessively for accessing their money. This book demonstrates that -- with careful planning and a relatively small investment -- the government's EFT initiative can have a major payoff in real assets and improved prospects for those who have been, for far too long, on the fringes of the country's mainstream banking system. Brookings Metro Series

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 232

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9780815780939

- Verschijningsdatum:

- 1/09/1999

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 154 mm x 232 mm

- Gewicht:

- 317 g

Alleen bij Standaard Boekhandel

+ 88 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.