- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

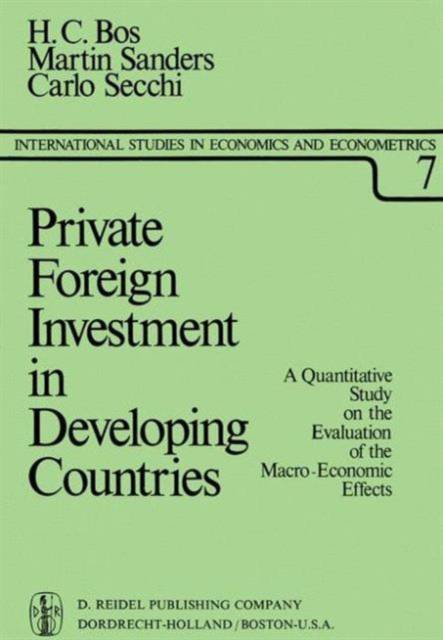

This study is the result of research undertaken by the Netherlands Economic Institute, Division Balanced International Growth, Rotterdam, under the auspices of the O.E.C.D. Development Centre. In the division of labour agreed with professor Grant L. Reuber, who directed a parallel study under the auspices of the Centre', the N.E.I. research deals with the evaluation of economic effects of private foreign investment in developing countries. The effects studied are confined to macro-economic effects which are quantifi- able. The lack of a satisfactory methodology for the assessment of these effects seemed to justify this limitation in the approach to the evaluation of private foreign investment. The study is organized as follows. Part I reviews briefly and critically the literature about the evaluation of private foreign investment and suggests the need for an appropriate macro-economic methodology. Part II develops the principles and techniques for such a methodology which is applied empirical- ly to data for five developing countries in Part III. While Parts II and III are concerned with the effects of aggregated volumes of private foreign invest- of the previous parts, the appraisal of ment, Part IV considers, independently projects financed through foreign investment and discusses the special fea- tures of social benefit-cost analysis of such projects.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 402

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 7

Eigenschappen

- Productcode (EAN):

- 9789027704108

- Verschijningsdatum:

- 31/03/1974

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Gewicht:

- 733 g

Alleen bij Standaard Boekhandel

+ 212 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.