Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Bedankt voor het vertrouwen het afgelopen jaar! Om jou te bedanken bieden we GRATIS verzending (in België) aan op alles gedurende de hele maand januari.

- Afhalen na 1 uur in een winkel met voorraad

- In januari gratis thuislevering in België

- Ruim aanbod met 7 miljoen producten

Zoeken

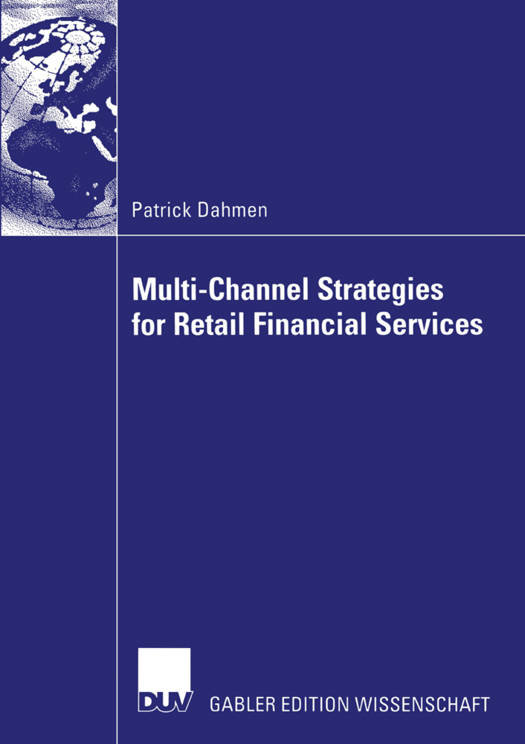

Multi-Channel Strategies for Retail Financial Services

A Management-Framework for Designing and Implementing Multi-Channel Strategies

Patrick Dahmen

Paperback | Engels

€ 111,95

+ 223 punten

Omschrijving

VII Foreword The retail financial services industry, especially the insurance industry, is undergoing fundamental changes. Prior to and in the aftermath of the deregulation of the insurance industry at the beginning of the 1990's, insurers have continued to focus more on stability and security rather than on efficiency and profitability. The capital market crisis, the deregulation, the gradual break-up of the traditionally integrated value chain coupled with the emergence of new players in the market as well technological advancements have all led to a fundamental shake-up of the financial services industry. Nevertheless, the cultural consequences of the regulated period are still visible today: in some insurance companies changes in the distribution of financial services can seldom be implemented without the acceptance of its tied agent channel, although experience from neighbouring industries, for example retail banking, clearly illustrates the necessity to align the distribution system with new trends in consumer behaviour, i. e. , with the general wish for more convenient shopping opportunities anywhere, anytime and in any way. Financial services are characterised by a high degree of interactivity with the customer during the entire process of service delivery, while information asymmetries arise as a result of the dominance of credence and experience qualities. The product "financial services" therefore goes far beyond its core product, e. g. risk protection; it covers all other elements of the customer relationship process.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 215

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783824481910

- Verschijningsdatum:

- 28/10/2004

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 148 mm x 210 mm

- Gewicht:

- 285 g

Alleen bij Standaard Boekhandel

+ 223 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.