- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

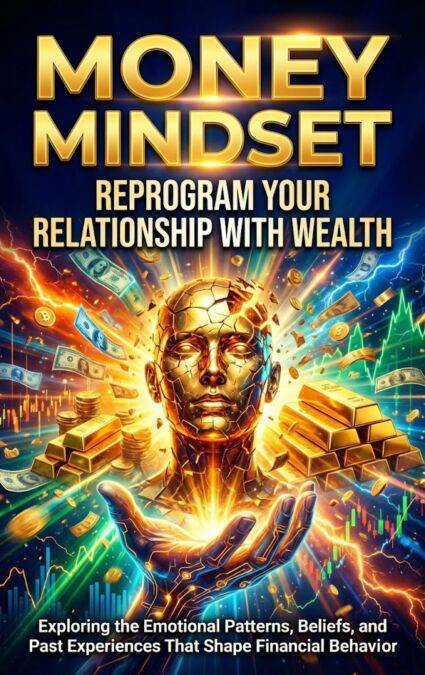

Money Mindset: Reprogram Your Relationship With Wealth E-BOOK

Exploring the Emotional Patterns, Beliefs, and Past Experiences That Shape Financial Behavior

Sarah Whitfield

E-book | Engels

€ 9,99

+ 9 punten

Omschrijving

This book explores the psychological relationship between identity and money by examining how early experiences, family dynamics, and cultural messages create lasting patterns around earning, spending, and self-worth. It investigates why financial decisions often feel emotionally charged rather than purely rational, and what this reveals about deeper beliefs regarding safety, value, and deservingness.

Rather than focusing on budgeting tactics or investment strategies, this book reframes money as an emotional territory where unconscious patterns play out—shame around scarcity, guilt around abundance, fear of losing control, or using spending as emotional regulation. It examines the neuroscience of financial stress, how childhood observations about money become internalized rules, and why shifting your relationship with wealth requires more than positive thinking. It explores the difference between genuine financial security and the illusion of control, between healthy ambition and compensating for feelings of unworthiness through accumulation.

Through compassionate inquiry, the book navigates the discomfort of examining money beliefs, the shame that accompanies financial struggles, and the complexity of wanting wealth while fearing judgment or loss of identity. It offers insight into recognizing which financial behaviors serve genuine needs versus which ones perpetuate anxiety, and how to discern between practical money management and the emotional work of untangling self-worth from net worth.

This is an invitation to approach your financial life not through reprogramming affirmations, but through honest exploration of what money represents to you, what patterns you inherited, and what becomes possible when you separate your value as a person from the numbers in your account.

Rather than focusing on budgeting tactics or investment strategies, this book reframes money as an emotional territory where unconscious patterns play out—shame around scarcity, guilt around abundance, fear of losing control, or using spending as emotional regulation. It examines the neuroscience of financial stress, how childhood observations about money become internalized rules, and why shifting your relationship with wealth requires more than positive thinking. It explores the difference between genuine financial security and the illusion of control, between healthy ambition and compensating for feelings of unworthiness through accumulation.

Through compassionate inquiry, the book navigates the discomfort of examining money beliefs, the shame that accompanies financial struggles, and the complexity of wanting wealth while fearing judgment or loss of identity. It offers insight into recognizing which financial behaviors serve genuine needs versus which ones perpetuate anxiety, and how to discern between practical money management and the emotional work of untangling self-worth from net worth.

This is an invitation to approach your financial life not through reprogramming affirmations, but through honest exploration of what money represents to you, what patterns you inherited, and what becomes possible when you separate your value as a person from the numbers in your account.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 196

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783565236985

- Verschijningsdatum:

- 10/02/2026

- Uitvoering:

- E-book

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 9 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.