- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

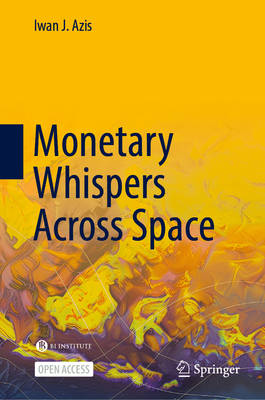

This open access book explores how macroeconomic policy, specifically monetary policy, interacts with interregional inequality. Using the case of monetary policy in Indonesia, a country with high interregional inequality, it examines how national-level policies can inadvertently deepen disparities between regions, and in turn contribute to the limited effectiveness of the policies. Undermining the local conditions, institutions, and spatial dynamics that could strengthen the centripetal forces plays a key role in such a negative feedback loop. Although monetary policy is designed to be neutral, the book argues that it can have uneven regional impacts. By amplifying the divide between already developed areas and those still catching up, such policies may undermine their own effectiveness. This self-reinforcing cycle is significantly shaped by the behavior of local banks' liquidity preferences, risk perceptions, and lending strategies, which can either connect or disconnect national policy goals from inclusive regional development. Drawing on macroregional data, quantitative models, field surveys, and interviews with local officials and bankers, the book offers compelling insights into one of the central challenges of economic policymaking in a diverse and decentralized nation. It also presents a powerful critique of the "spatial blindness" often embedded in economic governance.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 130

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9789819546244

- Verschijningsdatum:

- 29/01/2026

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 390 g

Alleen bij Standaard Boekhandel

+ 183 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.