- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

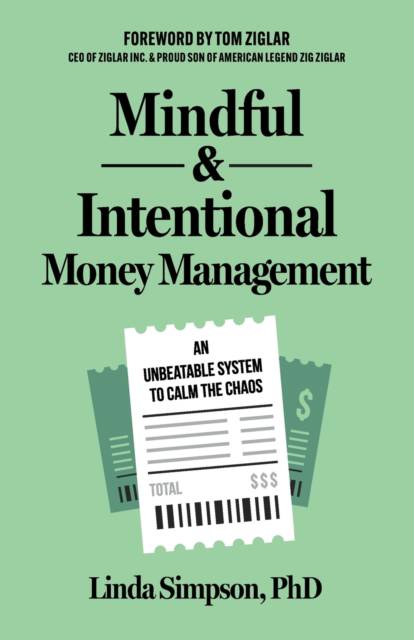

Mindful and Intentional Money Management

An Unbeatable System to Calm the Chaos

Linda Simpson

Paperback | Engels

€ 30,45

+ 60 punten

Omschrijving

Money impacts every facet of life. And constant money related concerns have a negative impact on a person's overall health and well-being. While money does not buy happiness, financial security can reduce stress and make life much easier to navigate. Mindful and Intentional Money Management takes people to the root of their money management behavior that has been formed by their money scripts (long held beliefs and perspectives on money that one has learned throughout life), personality, habits, attitude, and values. Dr. Simpson presents three action plans to build a solid financial foundation that include helping readers know where they're going (setting goals), know where they are (creating a financial snapshot), and learn/play/execute (bridging the gap between their goals and financial snapshot).Part 1 introduces the SMARTER goal system to guide readers to set mindful and intentional financial goals. In Part 2, readers compare their income and expenses, assets and debt, and debt-to-income ratio to determine their current net worth. This provides their financial snapshot. Part 3 instructs readers on how to plan and execute strategies to make behavior changes that lead to lasting change and progress that support a secure financial future.Readers will identify and eliminate poor money management behaviors and replace them with new habits that are sustainable and aligned with their value system and goals. The power of habits and creating muscle memory will automate money management decisions and make the change in behavior much easier. The strategies offered here can be life changing when applied.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 236

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781636982489

- Verschijningsdatum:

- 26/03/2024

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 140 mm x 216 mm

- Gewicht:

- 303 g

Alleen bij Standaard Boekhandel

+ 60 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.