- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 85,45

+ 170 punten

Omschrijving

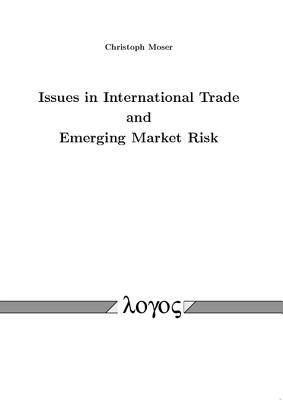

Over the last three decades, worldwide economic integration of goods markets and financial markets has increased substantially and has reached unprecedented levels, surpassing the pre-World War I peak. The consequences of global integration for emerging market economies and industrial countries are still hotly debated. This thesis contributes to this debate along two lines: First, we study the signals of incumbent governments to market participants on the eve of the change of key policy makers like the ministers of finance or economics and central bank governors in emerging markets. While chapter 2 is concerned with sovereign risk and proposes a new proxy for incumbent governments' willingness-to-repay its debt, chapter 3 discusses monetary credibility issues in the wake of central bank governor changes. We conclude from these two chapters that emerging market governments not only have to be careful in picking the right policy makers, but also have to pay attention to the way they manage the transition. Second, we analyze whether public export credit guarantees promote international trade flows in the presence of political risk (chapter 4) and whether international competitiveness impacts job flows in industrial countries (chapter 5). Based on German data, we identify a positive and significant trade promoting effect and suggest that German labor market institutions are important to understand labor market adjustment to real exchange rate changes.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 156

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783832519919

- Verschijningsdatum:

- 30/01/2009

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 145 mm x 203 mm

- Gewicht:

- 235 g

Alleen bij Standaard Boekhandel

+ 170 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.