- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

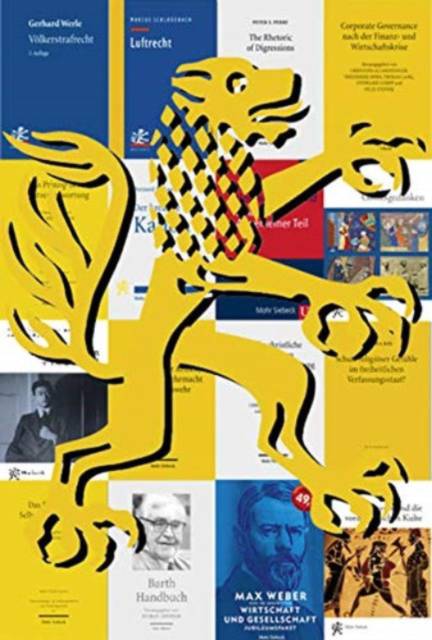

English summary: Auf privatwirtschaftlich organisierten Krankenversicherungsmarkten wird die Pramie entsprechend des individuellen Risikos erhoben. Verschlechtert sich der Gesundheitszustand einer Person, so besteht die Gefahr, dass die Pramie angehoben wird. Die Person sieht sich einer unsicheren Pramie gegenuber. Mathias Kifmann untersucht, wie dieses Pramienrisiko auf wettbewerblich organisierten Krankenversicherungsmarkten versichert werden kann. Drei grundsatzliche Moglichkeiten der Absicherung werden analysiert und verglichen. In einer vertiefenden theoretischen Analyse untersucht der Autor Reformmoglichkeiten der privaten und der gesetzlichen Krankenversicherung. German description: How can it be avoided that consumers face premium risk, i.e. increases in their premiums when their health status deteriorates? Mathias Kifmann examines how this problem which is a major challenge for private health insurance markets can be solved. Three principal ways to insure premium risk which preserve competition among health insurers are analyzed and compared. Guaranteed renewable contracts ensure premiums independent of changes in the health status by requiring a life-time commitment to an insurer. Premium insurance compensates an increase in premiums if the health status changes. Under community rating, the government rules out risk-based premiums by requiring that insurers set a uniform premium for all insured.Mathias Kifmann pays particular attention to the challenges posed by managed care. He argues that managed care can aggravate the lock-in problem under guaranteed renewable contracts. He demonstrates that an alternative contract is superior to guaranteed renewable contracts. This contract creates incentives for insurers to behave in the interest of consumers by specifying payments upon switching to another insurer. If insurers are community-rated, an important question is whether they should be allowed to offer managed care besides traditional health insurance. The author shows that managed care can be used as a pure risk-selection device under community rating. However, the introduction of managed care can also be to the benefit of everyone. To obtain such welfare gains, it may be necessary to tax some insurance plans and to subsidize others.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 155

- Taal:

- Duits

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783161477409

- Verschijningsdatum:

- 31/12/2002

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 161 mm x 242 mm

- Gewicht:

- 398 g

Alleen bij Standaard Boekhandel

+ 322 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.