- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

Omschrijving

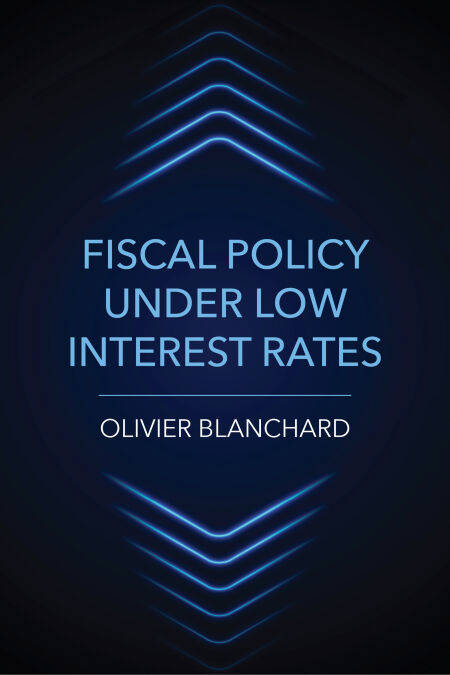

Rethinking fiscal and monetary policy in an economic environment of high debt and low interest rates.

Policy makers in advanced economies find themselves in an unusual fiscal environment: debt ratios are historically high, and—once the fight against inflation is won—real interest rates will likely be very low again. This combination calls for a rethinking of the role of fiscal and monetary policy—and this is just what Olivier Blanchard proposes in Fiscal Policy under Low Interest Rates.

There is a wide set of opinions about the direction that fiscal policy should take. Some, pointing to the high debt levels, make debt reduction an absolute priority. Others, pointing to the low interest rates, are less worried; they suggest that there is still fiscal space, and, if justified, further increases in debt should not be ruled out. Blanchard argues that low interest rates decrease not only the fiscal costs of debt but also the welfare costs of debt. At the same time, he shows how low rates decrease the room to maneuver in monetary policy—and thus increase the benefits of using fiscal policy, including deficits and debt, for macroeconomic stabilization. In short, low rates imply lower costs and higher benefits of debt.

Having sketched what optimal policy looks like, Blanchard considers three examples of fiscal policy in action: fiscal consolidation in the wake of the Global Financial Crisis, the large increase in debt in Japan, and the current US fiscal and monetary policy mix. His conclusions hold practical implications for economic and fiscal policy makers, bankers, and politicians around the world.

Policy makers in advanced economies find themselves in an unusual fiscal environment: debt ratios are historically high, and—once the fight against inflation is won—real interest rates will likely be very low again. This combination calls for a rethinking of the role of fiscal and monetary policy—and this is just what Olivier Blanchard proposes in Fiscal Policy under Low Interest Rates.

There is a wide set of opinions about the direction that fiscal policy should take. Some, pointing to the high debt levels, make debt reduction an absolute priority. Others, pointing to the low interest rates, are less worried; they suggest that there is still fiscal space, and, if justified, further increases in debt should not be ruled out. Blanchard argues that low interest rates decrease not only the fiscal costs of debt but also the welfare costs of debt. At the same time, he shows how low rates decrease the room to maneuver in monetary policy—and thus increase the benefits of using fiscal policy, including deficits and debt, for macroeconomic stabilization. In short, low rates imply lower costs and higher benefits of debt.

Having sketched what optimal policy looks like, Blanchard considers three examples of fiscal policy in action: fiscal consolidation in the wake of the Global Financial Crisis, the large increase in debt in Japan, and the current US fiscal and monetary policy mix. His conclusions hold practical implications for economic and fiscal policy makers, bankers, and politicians around the world.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 192

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780262372756

- Verschijningsdatum:

- 9/01/2023

- Uitvoering:

- E-book

- Beveiligd met:

- Adobe DRM

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 39 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.