- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

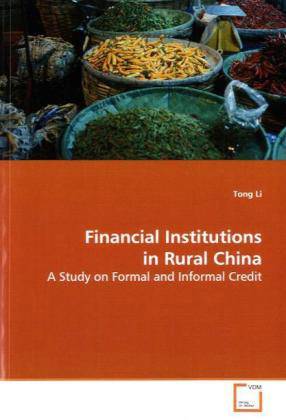

Financial Institutions in Rural China

A Study on Formal and Informal Credit

Tong Li

Paperback | Engels

€ 48,45

+ 96 punten

Omschrijving

China has become one of the world s biggest growth

engines. However, it is always critical to note that

China has a financial system that is dominated by

banking sector: one that is dominated by state-owned

banks, and banks that heavily favor state-owned

large corporations. Small and medium enterprises in

China generally experience a lack of access to

business capital. This is especially true in rural

area, where households are business units in need of

seasonal credit but with hardly any collateral. It

is therefore interesting to investigate the lending

situation in rural areas to see how informal lending

fills in the gap between demand for credit and

supply of credit by government and banks. Using data

from household surveys, the author found that

poverty alleviation loans are not reaching the

poorest segments of the rural population.

Furthermore, private lending is the most important

source of credit in rural China, and factors such as

higher disposable income and level of education lead

to more borrowing at the household level.

engines. However, it is always critical to note that

China has a financial system that is dominated by

banking sector: one that is dominated by state-owned

banks, and banks that heavily favor state-owned

large corporations. Small and medium enterprises in

China generally experience a lack of access to

business capital. This is especially true in rural

area, where households are business units in need of

seasonal credit but with hardly any collateral. It

is therefore interesting to investigate the lending

situation in rural areas to see how informal lending

fills in the gap between demand for credit and

supply of credit by government and banks. Using data

from household surveys, the author found that

poverty alleviation loans are not reaching the

poorest segments of the rural population.

Furthermore, private lending is the most important

source of credit in rural China, and factors such as

higher disposable income and level of education lead

to more borrowing at the household level.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 104

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9783639153835

- Uitvoering:

- Paperback

- Gewicht:

- 158 g

Alleen bij Standaard Boekhandel

+ 96 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.