- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

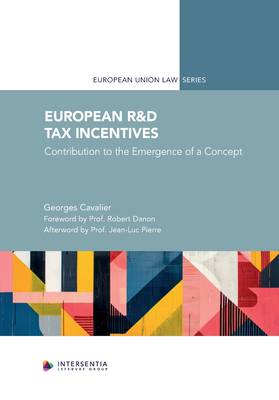

Research and development (R&D) taxation lies today at the heart of Europe’s economic and innovation policies. While all EU Member States – including Germany, long reluctant to do so – now rely on fiscal incentives for R&D in various forms, the absence of a shared conceptual framework weakens their effectiveness and fuels legal uncertainty.

This book, written, and coordinated for the national reports, by Georges Cavalier, Co-Director of the Tax Law Programme at Université Jean Moulin Lyon 3, offers the first comprehensive doctrinal study devoted to the construction of a European legal concept of R&D. The analysis addresses not only the tax notion of ‘research’ but also the definition of eligible expenditures under incentive schemes – issues that are central for both taxpayers and tax administrations.

By confronting national definitions with the OECD’s Frascati Manual, the author highlights contradictions, ambiguities, and their practical implications. Beyond a mere comparison, the book opens an innovative reflection aimed at simplifying European tax law, in line with the Union’s current priorities in innovation and fiscal governance.

The result of a rigorous and forward-looking research approach, this work builds on the projects of the European Law Institute (ELI) – of which the author is a Council Member – and the debates within the Platform for Tax Good Governance of the European Commission, where he represents the ELI. Combining methodological depth with practical insights, it is intended for researchers, tax law practitioners, policymakers, and European institutions. It stands as a key milestone in the pursuit of a clearer, more effective, and better-integrated European framework for R&D taxation.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 300

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9781839705625

- Verschijningsdatum:

- 24/11/2025

- Uitvoering:

- Paperback

- Afmetingen:

- 160 mm x 240 mm

- Gewicht:

- 480 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.