- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

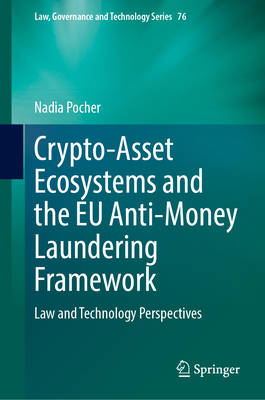

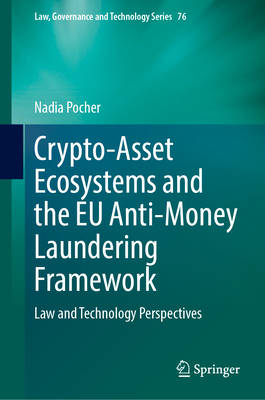

Crypto-Asset Ecosystems and the EU Anti-Money Laundering Framework

Law and Technology Perspectives

Nadia Pocher

€ 256,45

+ 512 punten

Omschrijving

This interdisciplinary monograph investigates crypto-asset ecosystems and their interplay with the framework to prevent money laundering and the financing of terrorism and proliferation (AML/CFT). Positioned at the intersection of legal research and technical analysis, it conceptualises crypto-asset ecosystems as interconnected socio-technical systems. Building on this foundation, it examines how varying degrees of anonymity, transparency, (non)centralisation, and (dis)intermediation shape both challenges and opportunities for compliance and oversight. The book engages with the operational dynamics and terminological ambiguities that underpin current understandings and regulatory responses to crypto-asset-related risks. It unpacks the concepts of transaction obfuscation and traceability, and investigates the accountability implications of diverse tools and techniques - ranging from self-hosted wallets and decentralised exchanges to privacy-enhanced protocols and machine-learning-driven analytics. Through this lens, it explores the relevance of techno-legal trade-offs in system design, as exemplified in proposed central bank digital currency (CBDC) models. A contextualised assessment of international standards and the European Union's evolving legal framework - including AML and AMLA Regulations, Crypto Travel Rule, and Markets in Crypto-Assets Regulation - serves as a foundation for a set of recommendations on how to holistically consider crypto-asset features in line with the AML/CFT risk-based approach. The methodology reflects the mutual interaction between regulation and technology within a co-regulatory setting, seen as a prerequisite to uphold compliance by (and through) design. Ultimately, the book advocates for a transposition model between AML/CFT risk indicators and techno-regulatory standards, informed by a risk-based taxonomy of crypto-asset ecosystems. Against the backdrop of rapidly evolving technologies, stakeholders, and risks, this monograph offers conceptual tools, terminological clarifications, and common discussion points across disciplines - including law, the social sciences, computer science and engineering, management and information systems. It provides a comprehensive foundation for scholars, practitioners, and policymakers engaged in shaping the future of crypto-asset regulation and compliance.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 297

- Taal:

- Engels

- Reeks:

- Reeksnummer:

- nr. 76

Eigenschappen

- Productcode (EAN):

- 9783031946974

- Verschijningsdatum:

- 15/07/2025

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 155 mm x 226 mm

- Gewicht:

- 612 g

Alleen bij Standaard Boekhandel

+ 512 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.