- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

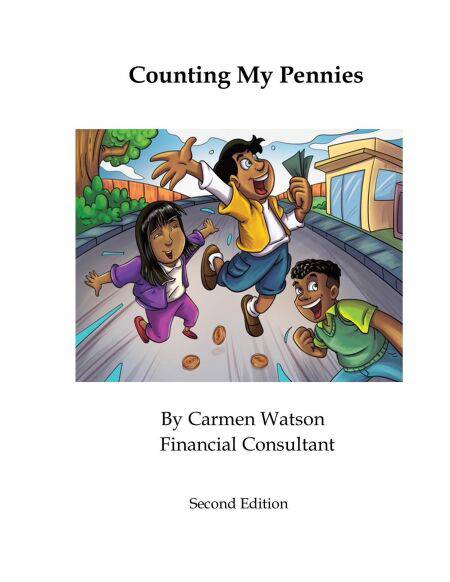

If you had a parent like mine, you probably didn't learn much about money in middle school. Why? They didn't feel that it was necessary at the time. It's not like we didn't have money problems in middle school back then, but they wanted us to focus on our Math and Reading classes. Even today, very little time is spent teaching children what they need to know about money. This book targets sixth to eighth graders to introduce them to the world of finances; Real World Finance Lessons for Kids and Teens teaches what's needed now. In the book, your children will learn:

• What is money? – Understanding the concepts of money is a step toward teaching our kids the value of money.

• Building a saving account – Financial literacy isn't just about accumulating wealth. It's about teaching your children how to save by picking up pennies and other coins and putting them in their piggy bank, which can later transfer to a saving account.

• How to budget? - As adults, we all know the trouble we can get into if we don't budget our money well. We'll break down this topic into guidelines, with examples of wants vs. needs.

• Career vs. Passive income - The secret of the wealthy; this is a concept not taught in schools but so important for your kids' future and financial success.

• Credit - What is credit, why is it important, and how do you make it work for you rather than against you? We'll explain the concepts and provide clear examples that will stay with kids for life.

• Savings & Investing – We all need to know how to save and invest, but now is the time to teach our children the overview of why saving and investing are essential and provide the financial journey to help them now.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9798215752906

- Verschijningsdatum:

- 21/09/2022

- Uitvoering:

- E-book

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.