- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

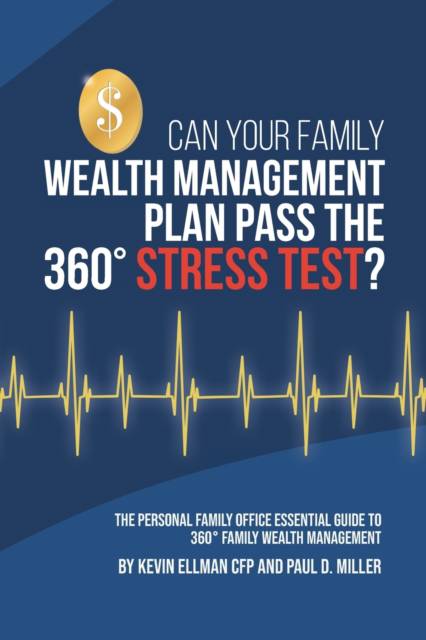

Can Your Family Wealth Management Plan Pass the 360° Stress Test?

The Personal Family Office Essential Guide to 360° Family Wealth Management

Kevin Ellman Cfp, Paul Miller

Paperback | Engels

€ 34,95

+ 69 punten

Omschrijving

Family businesses are the backbone of the American economy. It is not surprising, therefore, that many founders of family businesses want the fruits of their labor to survive and continue to grow for generations to come. For families of wealth, the set up and maintenance of a successful Wealth Preservation, Transfer and Succession Plan often involves complex elements and techniques that require advanced planning and proper tool implementation by a broad team of professionals. Unfortunately, a critical factor that Families of Wealth often overlook in this process is having a 360° Family Wealth Manager oversee and coordinate their diverse cast of professionals, frequently including lawyers, accountants, stockbrokers, insurance agents and bankers. This lack of oversight and coordination by a 360° Family Wealth Manager can result in unintended but severe consequences. Throughout this book, Kevin Ellman, CFP and Paul Miller, Family Wealth Managers, use a combination of case studies, and in-depth examination of the various planning tools, strategies, and techniques, that can be employed to help reduce or even eliminate the potential damaging effects of poor Wealth Preservation and Transfer Planning. In their view, Kevin and Paul believe that 360° Family Wealth Management provides the best opportunity for implementing and maintaining a successful Family Wealth Management Plan. Can Your Family Wealth Management Plan Pass The 360° STRESS TEST?

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 128

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9780578867632

- Verschijningsdatum:

- 1/03/2021

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 240 g

Alleen bij Standaard Boekhandel

+ 69 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.