- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

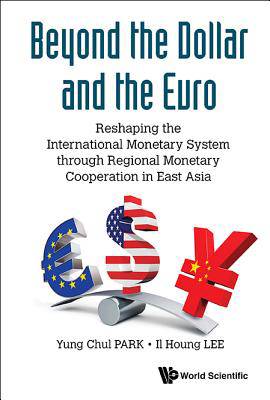

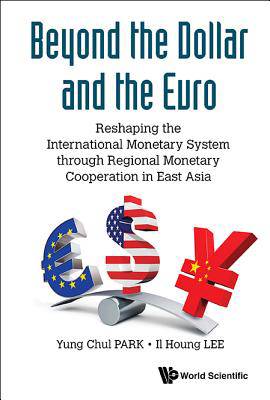

Beyond the Dollar and the Euro: Reshaping the International Monetary System Through Regional Monetary Cooperation in East Asia

Yung Chul Park, Il Houng Lee

Hardcover | Engels

€ 113,45

+ 226 punten

Omschrijving

Since the 2008 global financial crisis, the debate on the reform of the international monetary system (IMS) has gained new momentum. It questioned the desirability of the current system's excessive reliance on the US dollar despite the fact that the US financial system has proven to be less than perfect, and US monetary policy stance has not been in tune with the business cycle of the rest of the world. However, attempts to reform the IMF or strengthen regional safety nets have not produced material results. With the challenges in the euro area persisting, the dollar is very likely to stay as the main reserve currency for the foreseeable future.Against this background, this book prescribes concrete steps on how to shape an alternative monetary system that will be a win-win solution to all without having to strike an international agreement on a new global governance structure. It proposes to use the RMB -- already in motion to become an international currency -- to become the third pillar without the need for China to open its capital account prematurely.For policy makers, this book will help them rethink how they can approach the problems facing the IMS. For the general readers, it will offer them a comprehensive view on what the international monetary system is about, what the problems are, and how these problems can be addressed. In particular, it will equip them with a better sense of what currencies they will need to carry when traveling around the world, or in what currencies they should hold their wealth in the coming decades.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 176

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9789814749435

- Verschijningsdatum:

- 18/07/2016

- Uitvoering:

- Hardcover

- Formaat:

- Genaaid

- Afmetingen:

- 152 mm x 229 mm

- Gewicht:

- 403 g

Alleen bij Standaard Boekhandel

+ 226 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.