- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Omschrijving

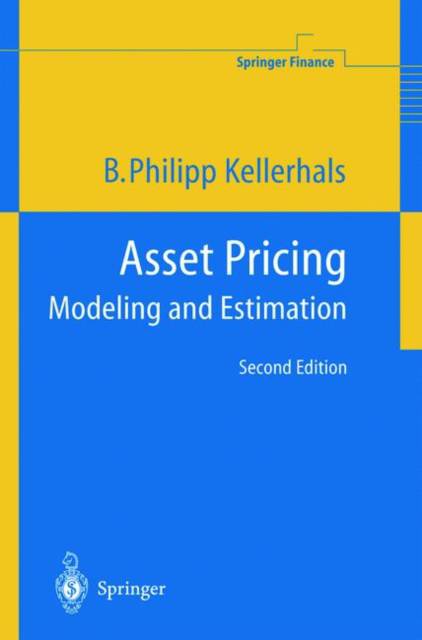

This updated second edition provides a framework that shows how to bridge the gap between the continuous-time pricing practice in financial engineering and the capital market data from discrete-time intervals. Starting with a comprehensive treatment of the particular stochastic modeling and econometric estimation framework, the main part of the book covers applications to risky assets traded on the markets for funds, fixed-income products and electricity derivatives. The second edition includes a new chapter on financial modeling which discusses vital PDE- and EMM-approaches. The reorganized and improved text further integrates the latest research contributions in the three covered application fields.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 243

- Taal:

- Engels

- Reeks:

Eigenschappen

- Productcode (EAN):

- 9783642058790

- Verschijningsdatum:

- 6/12/2010

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 367 g

Alleen bij Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.