- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

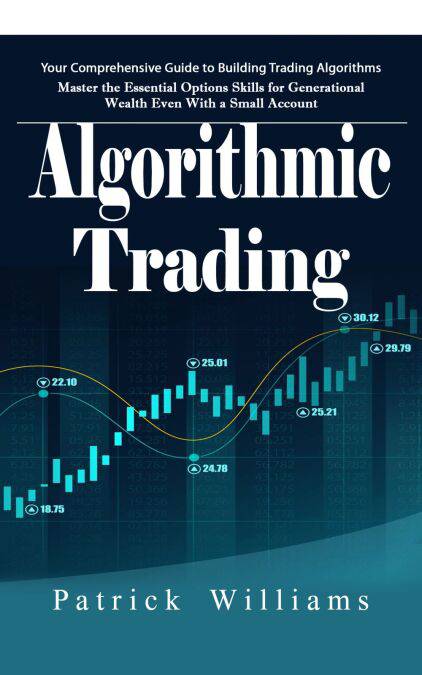

Algorithmic Trading: Your Comprehensive Guide to Building Trading Algorithms (Master the Essential Options Skills for Generational Wealth Even With a Small Account) E-BOOK

Patrick Williams

E-book | Engels

€ 2,99

+ 2 punten

Omschrijving

Algorithmic trading is not about complex mathematics or black-box magic; it is about defining a clear edge and executing it with flawless consistency. When you remove human emotion from the equation and rely on objective data, you stop gambling on market noise and start operating like a business. This book demystifies the world of automated trading, guiding you through the process of turning simple logic into robust, profitable systems using the accessible tools available on tradingview.

You’ll discover:

•How to spot common mistakes new algo traders make—and avoid the “optimization trap”

•A bar size study across 40 futures markets that reveals which timeframes actually work

•Mean reversion approaches that consistently outperform others

•Risk-protection methods to harden your strategies against drawdowns

•When bull/bear regime filters add real value (and when they don’t)

•Exit strategies that maximize reward-to-risk without killing profitability

•Real-world studies on profitable closes, reward ratios, and more

Across hedge funds, prop firms, and fintech platforms, airflow has quietly become the orchestration engine that keeps trading models running reliably. In this book, you will learn how to apply airflow to the unique demands of financial markets: real-time ingestion, event-driven triggers, multi-source pipelines, ml-based signal generation, and resilient execution pathways.

You will not just learn airflow as a tool. You will learn it as an engineering discipline central to quant trading success.

You’ll discover:

•How to spot common mistakes new algo traders make—and avoid the “optimization trap”

•A bar size study across 40 futures markets that reveals which timeframes actually work

•Mean reversion approaches that consistently outperform others

•Risk-protection methods to harden your strategies against drawdowns

•When bull/bear regime filters add real value (and when they don’t)

•Exit strategies that maximize reward-to-risk without killing profitability

•Real-world studies on profitable closes, reward ratios, and more

Across hedge funds, prop firms, and fintech platforms, airflow has quietly become the orchestration engine that keeps trading models running reliably. In this book, you will learn how to apply airflow to the unique demands of financial markets: real-time ingestion, event-driven triggers, multi-source pipelines, ml-based signal generation, and resilient execution pathways.

You will not just learn airflow as a tool. You will learn it as an engineering discipline central to quant trading success.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9798902162186

- Verschijningsdatum:

- 24/01/2026

- Uitvoering:

- E-book

- Beveiligd met:

- Digital watermarking

- Formaat:

- ePub

Alleen bij Standaard Boekhandel

+ 2 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.