- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

- Afhalen na 1 uur in een winkel met voorraad

- Gratis thuislevering in België vanaf € 30

- Ruim aanbod met 7 miljoen producten

Zoeken

€ 292,95

+ 585 punten

Omschrijving

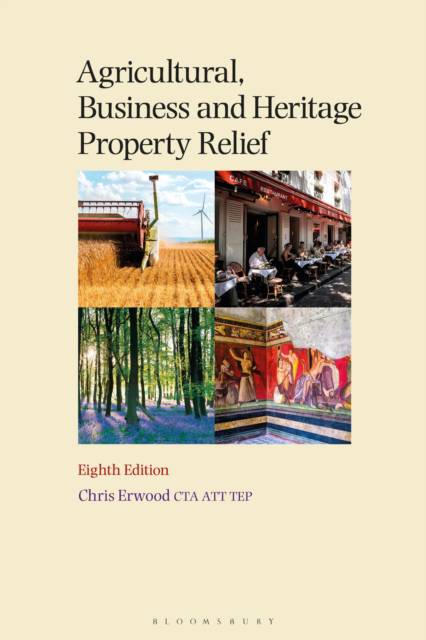

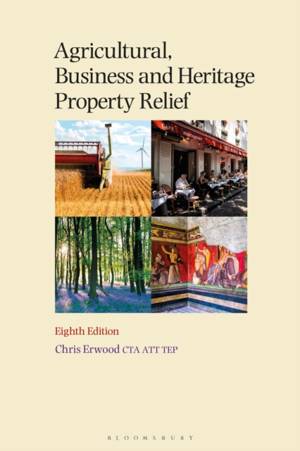

An expert guide to the rules of inheritance tax relief for business, farm, woodland and heritage property, and the only book on the market to cover all these reliefs in the same volume.

Significant changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) were announced in the 2024 Autumn Budget. This new edition covers all these changes, including: - The 100% relief currently available on all qualifying assets without any limit on value will now only be available on the first £1m of assets (in total) with a rate of 50% for assets above this limit.- Changes to application of relief to transfers on death and in the seven years before death - and how these will not be transferable to the spouse.

- BPR on shares quoted on a recognised stock exchange but treated as unquoted (such as AIM) will be 50% from this date and will not be able to benefit from 100% relief

- Coverage of numerous important tax cases in this area. The book discusses everyday situations that are likely to be encountered in practice and provides guidance on compliance, along with tips for making tax savings for clients. It also contains numerous examples of pitfalls to avoid in this complex area of tax law.

Specificaties

Betrokkenen

- Auteur(s):

- Uitgeverij:

Inhoud

- Aantal bladzijden:

- 560

- Taal:

- Engels

Eigenschappen

- Productcode (EAN):

- 9781526534460

- Verschijningsdatum:

- 2/03/2026

- Uitvoering:

- Paperback

- Formaat:

- Trade paperback (VS)

- Afmetingen:

- 156 mm x 234 mm

- Gewicht:

- 453 g

Alleen bij Standaard Boekhandel

+ 585 punten op je klantenkaart van Standaard Boekhandel

Beoordelingen

We publiceren alleen reviews die voldoen aan de voorwaarden voor reviews. Bekijk onze voorwaarden voor reviews.